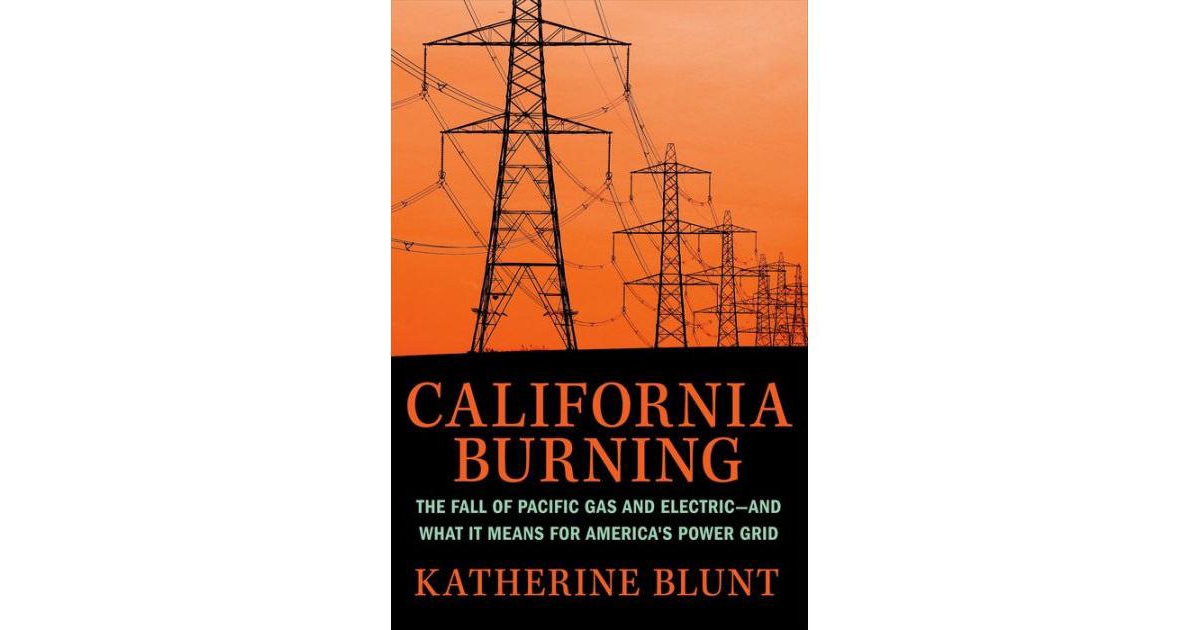

A revelatory, urgent narrative with national implications, exploring the decline of California's largest utility company that led to countless wildfires - including the one that destroyed the town of Paradise - and the human cost of infrastructure failure, Pacific Gas and Electric was a legacy company built by innovators and visionaries, establishing California as a desirable home and economic powerhouse. In California Burning, Wall Street Journal reporter and Pulitzer finalist Katherine Blunt examines how that legacy fell apart-unraveling a long history of deadly failures in which Pacific Gas and Electric endangered millions of Northern Californians, through criminal neglect of its infrastructure. As Pg&E prioritized profits and politics, power lines went unchecked-until a rusted hook purchased for 56 cents in 1921 split in two, sparking the deadliest wildfire in California history. Beginning with Pg&E's public reckoning after the Paradise fire, Blunt chronicles the evolution of Pg&E's shareholder base, from innovators who built some of California's first long-distance power lines to aggressive investors keen on reaping dividends. Following key players through pivotal decisions and legal battles, California Burning reveals the forces that shaped the plight of Pg&E: deregulation and market-gaming led by Enron Corp., and a swift increase in wildfire risk.